The Benefits of Forex Trading: A Comprehensive Guide

Forex trading has become a popular choice among investors and traders looking to capitalize on the fluctuations of currency values. The Forex market, with its vast potential and attractive opportunities, offers numerous benefits that make it an appealing option for individuals looking to build wealth. From high liquidity to the ability to trade 24/5, forex trading has unique advantages that can be harnessed by both novice and experienced traders alike. If you’re curious about the world of forex, we encourage you to explore benefit of forex trading Trading Platform MA as a starting point to dive into this exciting market.

1. High Liquidity

One of the most significant benefits of forex trading is its high liquidity. The forex market is the most traded market in the world, with an average daily trading volume exceeding $6 trillion. This level of liquidity ensures that transactions can be executed quickly without impacting market prices significantly. In practical terms, this means that traders can enter and exit positions with ease, making it simpler to react to market changes.

2. 24-Hour Market Access

The forex market operates 24 hours a day, five days a week, providing traders with flexibility and the ability to trade at any time. This continuous trading means that you can take advantage of market movements whenever you choose, whether it’s during the day or late at night. This flexibility is particularly beneficial for those who have other commitments or jobs, as they can trade at their convenience.

3. Low Barriers to Entry

Entering the forex market is relatively easy compared to other financial markets. Many brokers offer low minimum deposit requirements, allowing traders to start with small amounts of capital. Additionally, trading platforms and online resources are abundant, making it easy for beginners to learn the essentials of forex trading and start making informed decisions.

4. Leverage Opportunities

Forex trading allows traders to use leverage, meaning they can control larger positions than their initial investment. This can amplify potential profits; however, it’s important to note that it also increases the risk of losses. Responsible use of leverage can lead to substantial gains, making it an attractive feature for many traders.

5. Diversification

The foreign exchange market offers a wide variety of currency pairs to trade, allowing for diversification within your investment portfolio. Traders can take positions in various currencies, which reduces dependency on the performance of a single asset. This diversification can help to mitigate risks and enhance potential returns.

6. Potential for Profit in Rising and Falling Markets

In forex trading, traders can profit in both rising and falling markets. This means you can go long (buy) when you expect a currency to appreciate and go short (sell) when you anticipate a depreciation. This flexibility allows traders to develop strategies that can be profitable in various market conditions.

7. Use of Analytical Tools

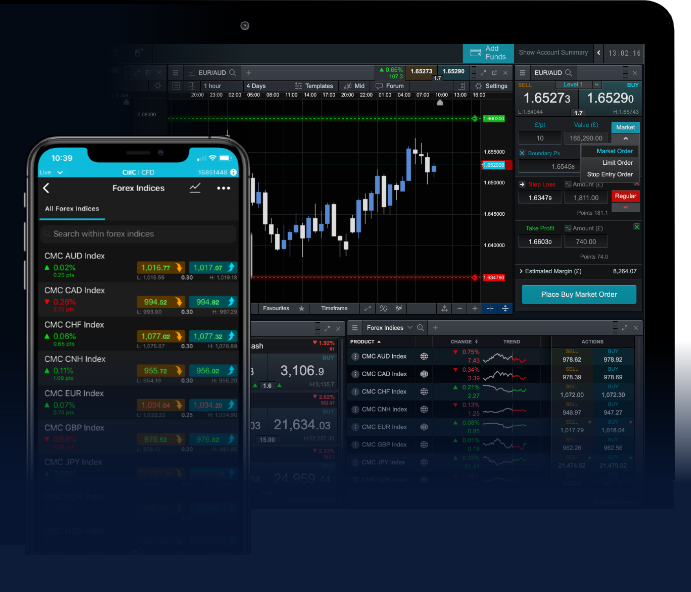

The forex market is rich with analytical tools and resources that traders can utilize to make informed decisions. Many trading platforms offer advanced charts, indicators, and technical analysis tools that can help traders identify trends and potential opportunities. Fundamental analysis is also crucial in forex trading, as economic events and news releases can significantly impact currency values.

8. Global Market Access

Trading in the forex market gives you access to global economies. With currencies from nearly all countries involved, you can trade pairs that involve major currencies like the US dollar, euro, British pound, and Japanese yen, as well as emerging market currencies. This global exposure allows for a wider range of opportunities and insights.

9. Community and Networking

The forex trading community is vast and diverse, comprising traders from various backgrounds and expertise levels. Engaging with this community can provide invaluable support, sharing of strategies, and tips for success. Many online forums and social media groups are dedicated to forex trading, where traders can discuss ideas, strategies, and challenges.

10. Building Financial Literacy

Engaging in forex trading can significantly enhance your financial literacy. As you learn about currency markets, trading strategies, and economic indicators, you’ll develop a deeper understanding of how global finance works. This knowledge can empower you in other areas of investment and personal finance.

Conclusion

The benefits of forex trading are substantial, offering traders the flexibility, liquidity, and opportunities to potentially generate significant returns. However, as with any form of trading, it’s essential to approach the forex market with diligence and an understanding of the risks involved. By leveraging educational resources, practicing sound trading strategies, and staying informed about market conditions, you can position yourself for success in the world of forex trading. Whether you’re just starting your trading journey or looking to enhance your current strategy, the forex market offers a wealth of opportunities waiting to be explored.