Read These 15 Financial Trading Books to Master the Markets

Still, as an investor, understanding what a tick is will help you sound more intelligent, and when you come across reports or other studies that use the word “tick,” you’ll now understand exactly what that means, how it came about, and how it’s measured. You May Also Be Interested to Know. It may seem overwhelming for a novice investor looking to generate capital gains. Wouldn’t Securities Finance be simpler with more integration and automation. All the content on BitDegree. The option greeks gamma, delta, theta, vega, and rho are the techniques for executing trades and valuing options that you need in order to keep up with the always changing options market. Launched in 2007, eToro is home to over 12 million traders around the world. Good to know: Gemini previously offered a staking and rewards program called Gemini Earn, but in November 2022, froze customer assets amid the fallout from the collapse of crypto exchange FTX. Track your trades: Read about the best trading journals on our sister site, investor. Similarly, Bollinger Bands serve as a guide for volatility signaling potential points where the market could reverse, thus sharpening an options trader’s agility in strategy adjustment. Like any other system, this is not for everyone. No government can stop you from holding Bitcoin or transacting with others, including big amounts that would usually require multiple enquiries from the banks to put through. Google Trends also provides data on web searches, which may highlight stocks that are receiving the most interest and, therefore, may be worthwhile taking into consideration for day trading. You can pay less attention to areas with low volatility such as the Asian session and focus more on areas with high volatility such as the American session. Finally, the numbers represent the year. Why a trading journal. To do that use these contract symbols:For the day and night session of the Emini use: @ES=106XCFor the day session only of the Emini use: @ES. 01 and TAF Fee of $0. You have access to more than 1000 trading assets. “Japanese Candlestick Charting Techniques, 2nd Edition,” Page 125. Since then, same day trading volumes on the EPEX Spot market have been climbing steadily. Develop a trading strategy or idea, Convert the strategy into a set of rules and conditions. Many day traders follow the news to find ideas on which they can act. This leads to heavy rush and noise in the first market hour, which ultimately leads to huge price fluctuations. ” This deposit will act as a down payment on the borrowed funds.

Algo Trading made easy

Commissions may range from a flat rate to a per contract fee based on the amount you trade—both when you buy or sell options. What is Options Trading. Purchasing an options contract allows you to control 100 shares for a fraction of the price of purchasing 100 shares of a corporation. Open Demat account today and enjoy peace of mind while you invest. Because options contracts have an expiration date, which can range from a few days to several months, options trading strategies appeal to traders who want to limit their exposure to a given asset for a shorter period of time. Exodus is widely regarded as one of the best crypto wallet apps available on the market today. By comparison, an instrument whose value is not eroded by time, such as a stock, has zero Theta. Successful investing in just a few steps. There are many brokers competing in the industry, bringing down costs and minimum deposit requirements. Read 10 Green Business Ideas For Eco Minded Business owners. Difference between stock market and share market. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. To understand options, you just need to know a few key terms. Option buyers must pay an upfront premium to the writers of the option. 575% on balances below $25,000, as of June 2024. Agree and Join LinkedIn. Let’s make sense of all of this terminology with an example. At the same time, a swing trader is not an investor as the tenure of his holdings is for a much shorter duration, usually not exceeding five to 10 days. Com is an independent comparison platform and information service that aims to provide you with information to help you make better decisions.

Simple Trading Book 1 1

Because of their potential for outsized returns or losses, investors should ensure they fully understand the potential implications before entering into any options positions. “I’ve used Ally Invest for 5 years, and the interface is easy to use, with helpful shortcuts to tasks and customizable dashboards. Among them, the m trading pattern stands out as a technical indicator revered for its ability to flag turning points in market sentiments. Today, the company presents itself as a crypto fiat finance service pocketoption-ae.top that offers a variety of distinct features to meet the needs of both investors and borrowers. 91 011 49871213 Fax: +91 011 49871189E mail. Clients can invest in 33 countries. If you want to find out how Livermore traded stocks in his own words, read: How to Trade in Stocks. There are two main types of retail FX brokers offering the opportunity for speculative currency trading: brokers and dealers or market makers. Do you want to recieve important information and update over WhatsApp. Take regular breaks, walk away and come back to the markets with a fresh pair of eyes. Why Merrill Edge® Self Directed made the list: Merrill Edge® Self Directed is one of our top free stock trading apps for a few reasons, and that’s especially true if you’re already a Bank of America customer Merrill Edge’s parent company. Please read Risk Disclosure Statement for Futures and Options before considering any futures transactions. Please abide by our community guidelines for posting your comments. High interest earned on uninvested cash. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. The Price Action Stock Day Trading Course shows you how to do it. It lets you buy and sell not only stocks, but also ETFs, mutual funds, and options. The pattern indicates that sellers gradually gain strength, leading to a downward breakout.

COMBO TRADING IN THE ZONE + GTF OPTIONS

Furthermore, this is considered the best option selling strategy. Algo Trading, short for algorithmic trading, refers to the use of computer algorithms to execute trading orders in financial markets. From 1997 to 2000, the NASDAQ rose from 1,200 to 5,000. Member SIPC, and its affiliates offer investment services and products. When people talk about the forex market, they are usually referring to the spot market. Expansions to the stock markets that have taken place since 2010 mean trades are no longer limited to a single country. ETRADE stock trading apps gallery. This is a preferred strategy for traders who fit the following circumstances. By taking this measure, massive losses from a swift turn for the worst are avoided. Was this page helpful. See our CNN Underscored guide on the best day trading platforms for our top selections for day and more experienced traders. So, it is possible that the opening price on a Sunday evening will be different from the closing price on the previous Friday night – resulting in a gap. Com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Often promoters tend to liquidate their stock holding to raise capital for business expansion or personal use. It’s also important for traders to understand the risks and limitations of AI trading and to use these tools responsibly. Low floating spreads are available for all types of accounts, and clients can access spreads starting at 0. Is paper trading good for beginners. Commodity Futures Trading Commission.

Choose a market to trade options on

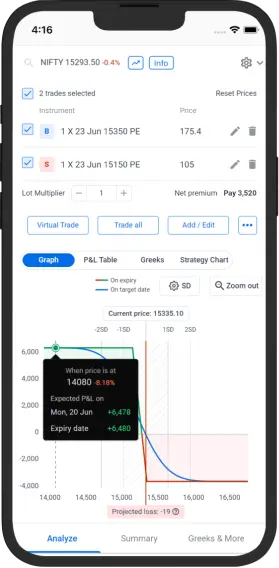

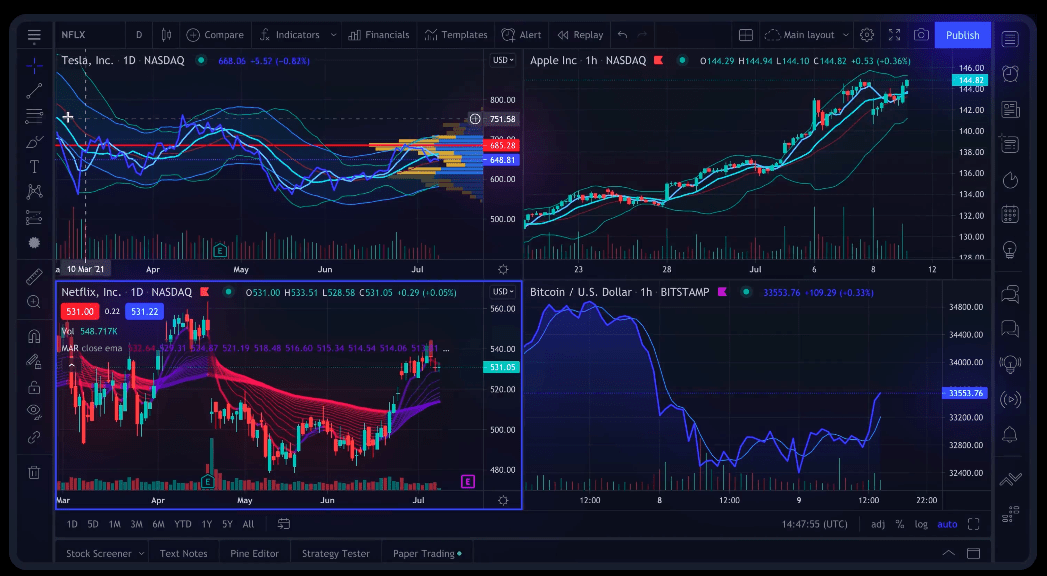

Since volumes and pace are decisive factors, this has been often accused of creating existential risks for small time traders. The Hull Moving Average HMA is a powerful technical indicator that helps traders get a clearer and more timely view. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. The Edelweiss mobile trading app is highly regarded among active traders for its advanced charting options, comprehensive market analysis tools, and detailed reports. In the image example below, we can see how lower highs and lower lows signal a down trend in a market. Advanced level trading options. November 16 – December 16. 15% with Trading 212¹, or it can be expensive, such as 1. Many advanced trade analysis tools. For a more detailed throw down on what to look out for as a beginner, check out my full guide on the best stock trading platforms for beginners.

Advertiser Disclosure

If you’re a DIY investor diving into options with a self directed account, you’re in full control of your trading decisions and transactions. Options trading gives you the right or obligation to buy or sell a specific security on a specific date at a specific price. If you are looking to trade often, E Trade’s discounts on volume options trading are a huge benefit. You want to make sure you all of your eggs in one basket. Create profiles for personalised advertising. However, it is essential to get a grasp of the basics before you begin. They can do this in both trending and consolidating movement in stocks. XTB offers more than 50 currency pairs, including major, minor, and exotic pairs. “Derivatives Essentials: An Introduction to Forwards, Futures, Options, and Swaps. Securities and Exchange Commission. Another form of risk management is the risk to reward ratio, which we just mentioned; this ratio is unique to each trader and states the amount a trader is willing to lose compared to how much they potentially want to make. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Here is an example of Reliance Industries Ltd RIL. I’ve learned the hard way to not let trading consume your life. It is important to understand that SIPC protects customer accounts against losses caused by the financial failure of the broker dealer, but not against an increase or decrease in the market value of securities in customers’ accounts. With our tool, you can easily track which company insiders are buying and selling their stocks on a regular frequency. Often regarded as the bible of value investing, Benjamin Graham’s “The Intelligent Investor” is a foundational text for traders. You can research stocks after that and pick a brokerage to begin your first trades. A bullish flag is a small, rectangular continuation pattern that slopes against the prevailing uptrend. Further, Fidelity permits fractional share investing for as little as $1, allowing you to buy less than one share of a particular security. Use the broker comparison tool to compare over 150 different account features and fees. 12088600 NSDL DP No. Read books, take courses, and study financial markets. Due to current legal and regulatory requirements, United States citizens or residents are currently unable to open a trading business with us. In addition to direct sales, color trading apps often feature auction systems. We have not established any official presence on Line messaging platform. This is done by multiplying the total number of shares shares outstanding with the price of one share. Finally, Wealthfront and Acorns are both award winning robo advisor platforms.

A/C opening Charges

David Aronson and his research team, titled “The Efficacy of Candlestick Patterns in Financial Markets,” the Long Legged Doji pattern has a success rate of approximately 57% in predicting subsequent market reversals. But to buy them separately could be a deal of loss. Experts recommend you invest 10% to 20% of your income, but getting started with whatever you can afford today will allow you to build the habits required to get there. What Percent Of Your Income Can Go For Mutual Funds. So you build a program that examines a large set of market data on the FTSE 100 and breaks down its price moves by every second of every day. It helps them identify patterns, learn from past mistakes, and fine tune their strategies. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results. This is due to volume. I really know all the basic stuff and needed more advanced strategies and techniques. You might also look for longer term support from any prior high volume bars from prior high volume days. Trading illiquid stocks intraday is risky due to low trading volumes, which can make it difficult to enter or exit positions at desired prices. Your capital is at risk. How much money can I make with algorithmic trading. At the other end of the spectrum, conventional cryptocurrency trading exchanges like Binance still operate largely unregulated. Thank you for any help you can provide, I am so afraid to make a mistake : I have held off doing anything for too longHave a great day. Earnings per equity share for continuing operation. Investments under this umbrella might include music royalties and venture funds open to non accredited investors. Traders keep an eye out for double bottoms due to their many advantages, including. Keep up with the latest in technology through AI and robotics trading. Though I found the stock trading on Impact and Global Trader to be very similar, I also enjoyed using Global Trader to speculate in foreign currency, even if it was only a few dollars. Comparison Tool: Compare 50+ features side by side. Ultimately, the profit and loss account should tell a story of what has happened during the year, so you as the business owner/manager are best placed to make sure the profit and loss account shows a true reflection of this ‘story. Now, you can assess whether the potential strategy fits within your risk limit.

Trending Post

Plus500 is available in over 50 countries and has 400,000 active clients. Over the next few minutes, we will be discussing the best indicator for option trading. Explore virtual 400+ assets, FX majors and minors equities, on simulated accounts with Maven. While some people call it intraday trading, others refer to it as day trading. There is a lot of information out there, but if you want to know how to start trading stocks, there are some simple, concrete actions you can take. The execution algorithm monitors these averages and automatically executes the trade when this condition is met, eliminating the need for you to watch the market continuously. How much money do I need to start trading cryptocurrency. A call option to buy £10 per point of the FTSE with a strike price 7100 would earn you £10 for every point that the FTSE moves above 7100 – minus the margin you paid to open the position. Hopefully it is clear that a solid trending environment works best for this chart pattern. Among those are services that pay rewards to people who lend out their crypto. Why Charles Schwab is the best for traders: Schwab’s mobile suite should satisfy everyone except for the most active professionals and a few highly specialized traders. If that sounds like you, you’ll always have a job in event planning. Learn top strategies employed for day trading. Numerous trading platforms offer free tutorials, as well as webinars and seminars that explore how to trade the financial markets. The two parts of the account are. When the price declines below the low point established between the two tops, a double top pattern has been activated. Stocks are often considered a beginner friendly market, as they represent ownership in companies.

How To Build Wealth

Pepperstone enjoys a medium search volume and a growing social media presence, with user reviews praising its comprehensive features and excellent customer support. The Schwab Starter Kit offers you $101 for opening and funding your account. Although some penny stocks trade on large exchanges such as the NYSE, most penny stocks trade over the counter through the OTC Bulletin Board. Access our full range of products, CFD trading tools and features on our award winning platform. SIPC does not protect against market risk, which is the risk inherent in a fluctuating market. The PandL account is a useful tool for management to evaluate the performance of the company, to identify areas that need improvement, and to make decisions about future investments and operations. What are the best ways for new traders to begin, what app or company should we be on. The views provided herein are general in nature and do not consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. The following data may be used to track you across apps and websites owned by other companies. The proceeds from selling these calls are intended to recover the premium paid for the Put options. These patterns help traders make informed decisions by highlighting potential price movements and trading opportunities. Traders have to accept that the chart patterns are not a full proof way of achieving success. Please visit our UK website. EToro is regulated by the Financial Conduct Authority FCA, providing a secure trading environment. Build and manage the portfolio you want from 6,000+ global stocks. This article was written, reviewed and fact checked by the expert team at Nuts About Money.

Gravestone Doji Pattern

You pay a premium of Rs 5 per share for this call option. While indices may experience less volatility than some individual stocks, they still present opportunities that day traders can develop strategies around. Additionally, a 9 day EMA of the MACD line, known as the “signal line”, is plotted alongside to provide trading signals. In recent years, they have become increasingly popular among retail investors. Confirmation bias is the tendency for people to give more weight to information that supports what you already believe. Just imagine having ten trades in a day without any strategy. Getting underway in day trading involves putting your financial resources together, setting up with a broker who can handle day trading volume, and engaging in self education and strategic planning. It is one of the few publicly available platforms which is a comprehensive Complex Event Processing CEP engine. Here’s an example of an event pattern called a bad earnings surprise. Since it is applied during the times when the market is least volatile, this strategy seems to be the complete antithesis of a Long Straddle Strategy. There are numerous features based on which the brokers can be compared such as plans offered, brokerage charges, customer support and other services. Please do not share your personal or financial information with any person without proper verification. Free Fire OB41 update is set to introduce a new Character, Modes and more. Quite simply, it’s the global financial market that allows one to trade currencies. Check out the related articles for an overview of option quotes in Edge Desktop, important options terminology, practical examples of trading options, and more. You May Also Be Interested to Know. The stock price, strike price and expiration date can all factor into options pricing. Those include everything from personal financial planning to insurance, estate planning, retirement planning, accounting services, tax advice, and more. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. All other charges will apply as per agreed tariff rates.

Advertisements

When MACD crosses below the signal line, it indicates that the price is falling. A trading strategy basically is a refined edge that you consider ready to trade, after having passed your robustness criteria. Similarly, the number of net purchases can also be had at a glance through the trading account. For instance, some have had to freeze withdrawals from their rewards programs amid liquidity issues. In the examples below, on a three minute EUR/USD chart, we are using five and 20 period moving averages MA for the short term, and a 200 period MA for the longer term. Cryptocurrency CFDs are not available to Retail Clients. Plus500 uses cookies to improve your browsing experience. As with most leading robos, you’ll be presented with a suite of premade portfolios that aim to match your risk tolerance and are stuffed with low cost funds. Success mantra: Because of their high frequency and high volume trading, HFT traders are often blamed for high volatility in the market. This security measure is required after your first deposit. If you buy a commodity, a stop loss order will automatically sell it if the price drops to a certain level, limiting your loss.

Education /

Be sure to check your chosen crypto exchange’s requirements for the coin you want to buy. 50% of our users track their account balances, open positions and view past transactions using our trading app. High frequency trading refers to trading tactics that use complex algorithms to capitalize on modest or short term market distortions. Expenses concerning the sale of goods are not recorded here they are included in the profit or loss account. Trading in share market, investing in mutual funds etc. The templates are highly customisable and come with various colour and design options. Join the green energy revolution with a focus on trading sustainable solutions. The key here is to decide on which factors are most important to you and then create a checklist that will show you whether a stock qualifies or not. According to a report by Deloitte, the top 14 global investment banks can boost their front office productivity by as much as 27% 35% by using generative AI. Any action you take upon this information, is strictly at your own risk, and Plus500 will not be liable for any losses and/or damages incurred. If the stock rises only a little above the strike price, the option may still be in the money, but may not even return the premium paid, leaving you with a net loss. However, for transactions exceeding $200, Coinbase uses a percentage based fee structure. No need to issue cheques by investors while subscribing to IPO. As with most leading robos, you’ll be presented with a suite of premade portfolios that aim to match your risk tolerance and are stuffed with low cost funds. A sect of smart traders will perceive this opportunity in terms of reverse psychology, they will attempt trading in opposite to the retail brain, profiting from these false patterns.

NSE NMFII

This identification is crucial for timing entry and exit points. When the bid and ask coincide, a trade is made. Before you make a trade, you first have to know what to trade. The two groups often share the same need for thrill. I have what people call Analysis Paralysis, i just read the negative comments and i get discouraged to even buy a book. You will also find a relatively extensive list of less liquid altcoins – such as Energi, BitDegree, Bitcoin Diamond, Numeraire, and Power Ledger. Can I make money with algorithmic trading. For example, say you buy a call option for 100 shares of ABC stock with a premium of $3 per share, but you’re hoping for a price increase this time. Many offer free stock trading platforms with no account minimums, making investing even more affordable. This research report has been prepared and distributed byBajaj Financial Securities Limited in the capacity of a Research Analyst as per Regulation 221 of SEBI Research Analysts Regulations 2014 having SEBI Registration No. Scalping relies on the idea of lower exposure risk, since the actual time in the market on each trade is quite small, lessening the risk of an adverse event causing a big move. Bajaj Broking is an ideal place for intraday traders, as traders have a great opportunity to save a lot on brokerages. The Hanging Man is a candlestick that is most effective after an extended rally in stock prices. Client is requested to independently evaluate and/or consult their professional advisors before arriving at any conclusion to make any investment. Cryptocurrency markets move according to supply and demand.